Are you on top of your business’s tax records? Do you know if you’re keeping the right documents for enough time? Let’s dive into the essentials of business tax record keeping. We’ll look at the best practices to keep everything in order, stay compliant with the IRS, and manage your finances well.

Key Takeaways:

- Understanding the IRS guidelines is crucial for efficient business tax record keeping.

- Tax returns, employment tax records, and records relating to property are among the documents you should keep for a specified period.

- Using record-keeping software and digital solutions can simplify organization and improve access to records.

- Employee records and corporate records should be maintained accurately and securely.

- Consulting with professionals can provide valuable guidance in developing a record retention plan and ensuring compliance.

What Documents to Keep for Tax Purposes

For tax purposes, small business owners need to keep several documents. These help with tax compliance and financial management. Keeping these records organized can avoid penalties, ease audits, and aid in smart financial planning.

Here are the main documents small businesses should hold onto:

- Tax Returns: The base of your tax documents is your tax returns. You should keep all your filed returns and supporting papers for a minimum of 3 years. In certain cases, like if you’re claiming a refund or have unreported income, you might need to keep them longer.

- Expense Receipts: Keep all your business-related expense receipts and invoices. This includes costs for office supplies, equipment, travel, meals, and entertainment. These receipts prove your deductions and show valid business expenses.

- Income Documents: Store records of all your business income. This can be sales invoices, cash register tapes, and bank deposit slips. Such documents prove your reported income and follow IRS rules.

- Employee Records: If you have employees, keep their wage and tax withholding information. This also includes W-2 forms, payroll data, and employment contracts. These are key for payroll taxes and following the law.

- Property Records: For businesses that own or rent property, maintain records of property dealings, improvements, and repairs. These help calculate depreciation and find out profits or losses on property sales. Keep records of tax-free exchanges too.

“Having accurate and organized tax records is more than just meeting legal requirements. It also gives you deep insights for sound financial managing.” – Your Business Name

Keep in mind, the records you need can vary by business type and industry rules. Knowing IRS guidelines and talking with a tax expert is useful. They can tell you what records to keep and for how long.

Best Practices for Organizing and Storing Tax Records

Proper organization and storage are crucial for efficient tax record keeping. By following best practices, accessing your tax documents becomes easy. This ensures you stay in line with IRS regulations.

Using record-keeping software designed for businesses is a smart move. It lets you organize tax documents and manage financial records smoothly. Plus, you can store your tax records digitally, making them easy to find.

Switching to digital tax records is another great option. It means less physical storage and paper mess. Your records are safe in the cloud, ready to check or manage from anywhere.

Creating a consistent naming and filing system helps a lot. It makes finding records fast and reduces tax time stress. Choose names that clearly describe each document.

Whether storing records physically or digitally, security is key. It’s vital to protect against data breaches and unauthorized access. For physical records, use a secure, fire-resistant spot. For digital ones, use strong security steps like encryption and backups.

Following these tips for organizing and storing tax documents sets your business up for success. It makes managing taxes easier. And it keeps you compliant, making tax time smooth.

Duration of Record Keeping for Employment Taxes

Understanding how long to keep employment tax records is key for IRS compliance. The IRS says to keep employment tax records for at least 4 years. This is after the tax due date or the payment date, whichever comes later.

These include things like payroll tax returns, payroll checks, and time reports. Also, attendance records and commission reports must be kept. Keeping these small business tax records for the required time helps with accurate reporting. It also prepares you for any audits.

It’s important for employers to organize these records well. This way, they help meet IRS rules. They also have a reliable source of tax info.

Keeping employment tax records right is crucial for reporting wages and taxes well. It helps with any future checks or questions. Following these rules shows you are open and committed to IRS compliance.

Record Keeping for Specific Assets

Keeping good records for specific assets is crucial for tax and financial management. It ensures you’re following IRS rules and keeping your taxes in order.

For things like homes, real estate, and stocks, keep all your paperwork. This includes statements and receipts. The IRS says to keep these for 7 years after selling the asset. This helps businesses figure out profits or losses. It also helps them stick to IRS rules.

Always keep depreciation schedules and lists of assets forever. These records help assess the value of your assets accurately. They also help businesses manage their assets wisely.

Good record keeping helps small businesses follow IRS rules. Plus, it sets up a strong system for accurate financial reporting. This helps in making smart decisions.

Sample Table: Record Keeping Checklist for Specific Assets

| Asset Type | Documents to Keep | Retention Period |

|---|---|---|

| Residence | Mortgage documents, purchase agreements, closing statements | 7 years after property sold |

| Real Estate | Deeds, leases, property tax records | 7 years after property sold or disposed of |

| Stocks | Brokerage statements, purchase confirmations | 7 years after stocks are sold |

| Other Assets | Documentation related to purchase, maintenance, disposal | 7 years after asset is sold or disposed of |

Talk to a tax expert or accountant to make sure you’re following IRS rules and any special requirements for your industry.

Please note: The table above is just a starting point for understanding what documents to keep. It is a sample checklist for specific assets. The real requirements can depend on the asset and tax laws.

Corporate Record Keeping

Keeping corporate records is key to follow laws and manage money well. By keeping clear and current records, companies can dodge fines, legal troubles, and choose wisely for their future.

Some key papers for corporate records include:

- Annual Reports: These sum up a company’s money situation over a year. They show earnings, costs, and profits.

- Articles of Incorporation: This paper officially starts a corporation. It lists the business name, its purpose, and the main contact.

- Stock Ownership and Transfers: Keeping tabs on who owns stock and any changes is crucial. It covers share numbers, dates, and any swaps.

- Bylaws: Bylaws set the rules for how a company runs. This includes when shareholders meet, what directors do, and how voting works.

- Dividend Registers and Canceled Dividend Checks: These track dividends given to shareholders. Canceled checks prove payment. They’re important for correct money reports.

- Business Licenses and Permits: Licenses and permits let a business operate legally. Keeping these documents up to date ensures you’re following the law.

It’s critical to organize and keep these records safe. A mix of digital and physical storage makes things smoother and more secure. Plus, keeping hard copies locked up helps protect private information.

Employee Record Keeping

As a small business owner, it’s key to keep accurate employee records. This is not just for IRS rules but also to protect your business. Documenting hours worked, pay, benefits, and tax info helps keep things clear. This way, you can avoid fines or legal problems.

Keep employee records for as long as they work for you and for 3 years after they leave. This includes contracts, W-4 forms, timecards, payroll details, and more. The kind of records you need to keep can depend on your business and the laws that apply to it.

Following the IRS’s rules on keeping employee records is important. This helps you avoid fines and correctly report what you pay your employees and their benefits. The IRS needs records that show how you figure out taxes for Social Security, Medicare, and federal income.

Think about using digital ways to keep records or software made for small businesses. These can make organizing easier, help you find info quickly, and keep employee data safe.

Good record keeping means you meet the law’s demands and have important info ready for audits, disagreements, or questions. You can look back on employee pay history, benefit eligibility, and how you followed employment laws.

Record keeping is something you have to keep doing. Check and update your records often. This makes sure they are right and meet current laws. By focusing on keeping good records, you can protect your business, build trust with your team, and encourage openness and responsibility.

Benefits of Effective Employee Record Keeping:

- Ensures compliance with IRS guidelines

- Provides accurate documentation for tax reporting

- Fosters transparency and accountability within the organization

- Aids in resolving employee disputes or inquiries

- Assists in calculating employee benefits and compensation

- Offers valuable insights into workforce trends and patterns

Creating a good system for employee records helps your small business with tax documents and IRS rules. Using the best methods and digital solutions can make things smoother. This protects your business’s interests.

Storage and Digital Solutions

Businesses today are moving towards digital solutions to manage tax records more efficiently. This includes adopting record-keeping software made just for them. These tools not only provide remote access to documents but also cut down on the need for physical files. They make it easier to index, store, preserve, and retrieve records in a clear format.

Cloud-based software is especially good for securely saving records online. This approach avoids the dangers of physical damage or loss. It ensures all tax documents are in one place, making it simpler to find and access them. Additionally, these platforms often come with powerful search tools. These help users quickly find documents by date, type, or keyword.

Keeping tax documents safe is critical, as they hold sensitive data. It’s important to choose software that makes data security a top priority. The best options use encryption, control access, verify users, and back up data regularly. This keeps your information safe and private.

Even with digital options, keeping physical records in order is necessary. Store these documents safely, perhaps in locked cabinets or safes, to guard against theft or damage. Proper labels and organization help you find documents quickly when needed.

It’s also vital to regularly check and update the records you keep. Holding onto old, unnecessary documents can lead to clutter and increased security risks. Safely getting rid of unwanted papers, particularly those with personal info, can protect against identity theft.

Legal Document Retention

It is crucial for small businesses to properly keep legal documents. This ensures they follow the law, protect their interests, and run smoothly. Keeping important papers like permits, licenses, and contracts is key to success. Some major tips for holding onto legal documents include:

Documents to Keep Permanently

Certain documents should always be kept. These are:

- Bills of sale

- Permits and licenses

- Contracts

- Deeds and titles

- Mortgages

- Stock and bond records

Documents to Keep for 10 Years

Keep canceled leases and received notes for ten years after they end.

Consulting with Professionals

Talking to an attorney or accountant is wise for your business. They will help you understand which documents to keep and for how long. Their advice is tailored to your industry and business model.

“Proper legal document retention is essential for small businesses to maintain compliance, protect their interests, and ensure smooth operations.”

Organizing legal documents properly helps small businesses handle legal matters well. Keeping and managing documents in a systematic way saves time when they’re needed. Knowing the legal rules for keeping documents and seeking expert advice is vital.

| Document Type | Retention Period |

|---|---|

| Bills of Sale | Permanent |

| Permits and Licenses | Permanent |

| Contracts | Permanent |

| Deeds and Titles | Permanent |

| Mortgages | Permanent |

| Stock and Bond Records | Permanent |

| Canceled Leases | 10 years after cancellation |

| Notes Receivable | 10 years after cancellation |

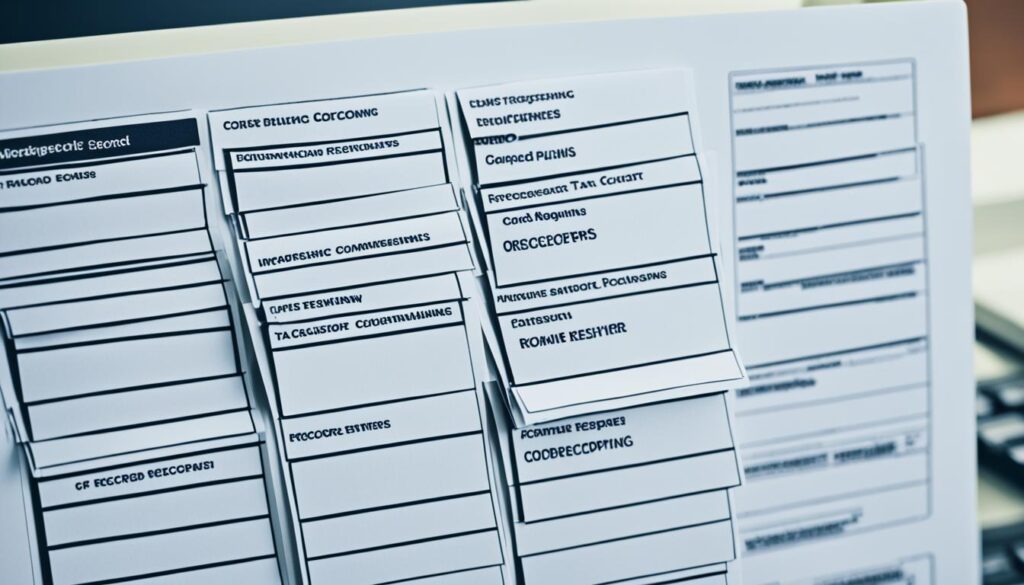

Consulting with Professionals

Dealing with tax documentation organization and small business tax records can be tricky. Professionals like accountants can offer a lot of help. They tailor a record retention plan that fits your business perfectly. Their knowledge about IRS compliance records ensures your records are kept right.

Getting help from experts saves you time and keeps you in good standing with tax offices. They improve how you keep tax records. Their guidance helps you follow tax rules, avoid fines, and be ready for audits.

Working with experts gives you confidence that your record retention plan meets IRS standards. They’ll tell you how long to keep documents. This helps you keep what’s needed and avoid clutter. If you aim to improve your tax record keeping, seeking professional advice is wise for your business’s future success.